Monolithic vs Modular vs Multi-Chain: Where Does Saga Fit In?

“Internet-scale use cases for blockchain technology will emerge only when multi-chain is as simple to use as a monolithic blockchain” — Jin Kwon, Co-Founder of Saga

Introduction

Public blockchains — the primary technology powering Web3 — has four core elements: Execution, Consensus, Data Availability and Settlement. Many public blockchains have gone in a monolithic direction whereby these four elements are completed by a single set of validators/miners, and all transactions are settled on a single chain. Other blockchains have adopted a modular approach where these four elements may be completed by a multitude of separate actors. The Cosmos ecosystem has pioneered the multi-chain approach where settlement is done on independent sovereign chains. All these design decisions impact the security, scalability and decentralization of a blockchain ecosystem and are important factors for a dApp developer to consider as they choose where to launch their own applications.

In this article, we will discuss each of these design vectors, with a focus on security in light of the recent collapse of LUNA. We’ll also discuss Saga’s architecture and how it may be ideally suited to birth the next 1000 chains into the multiverse.

Four Core Elements of a Public Blockchain

The four elements of a public blockchain are Consensus, Execution, Data Availability and Settlement. Consensus is related to the mechanism whereby validators/miners can come to agreement on the order of transactions (also known as messages) for a specific block. Execution refers to the computation required to make state changes from the set of transactions in a new block. Settlement refers to the finalization of any state-transition on a blockchain. Data Availability is a subtle concept but generally refers to the notion that data posted on the blockchain can be downloaded by anyone and verified to match everyone else’s version of history. These four features of a blockchain can be remembered by the acronym D.E.C.S.

Monolithic Blockchains

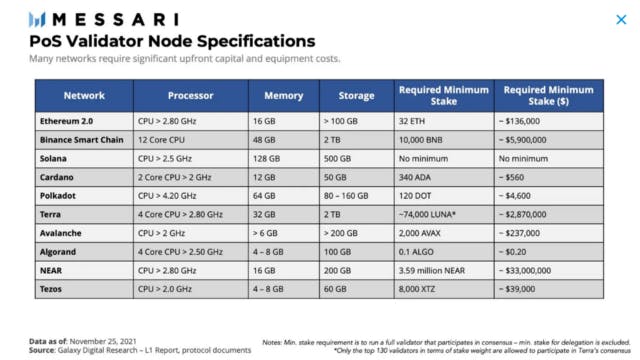

In a monolithic blockchain like Solana or Binance Smart Chain (BSC), validators are responsible for all aspects of DECS: validators agree on the order of transactions, provide compute resources for execution, settle state-transitions and make all data available for public verification. In a monolithic blockchain, one of the few paths to scalability is to increase block size or decrease the time between blocks. This requires validators to increase resource requirements such as compute power, memory or storage. For example, a validator on Solana would need a CPU greater than 2.5 GHz, 128 GB memory, and 500 GB of storage, which results in a theoretical throughput of over 50,000 TPS. A validator on the Binance Smart Chain would need a 12 Core CPU processor, 48 GB memory and over 2TB of storage.

The primary benefits of a monolithic architecture are the ease of deployment and the composability of applications. A dApp developer on Solana can focus more on the core business logic of their application and less on the nuances of DECS. Also, since all applications exist on a single chain, applications can be easily ‘composed’ to interact with each other. For example, Serum is an order-book DEX built on Solana, and a protocol like Raydium can build an AMM (automated market maker) that shares liquidity with the Serum order-book.

In a monolithic blockchain, dApps still compete with each other for a finite amount of blockspace, which can result in potential congestion issues on even the highest throughput chains. CryptoKitties, one of the original crypto games, at one point accounted for 12% of transactions on Ethereum in 2017. A Raydium IDO (Initial Dex Offering) on Solana resulted in such severe congestion that resulted in a halt of the chain. Cabadra, a GameFi project on Avalanche, accounted for more than 50% of fees on Avalanche’s C-chain in the first week of April 2022, leading to a spike in fees that rival that of Ethereum. Users of other applications that share blockspace during times of congestion on these monolithic chains are more likely to have a poor user experience.

To address congestion issues, monolithic chains can increase throughput via vertical scaling — enlarging validator requirements to improve the speed at which blocks are produced or increasing the size of each block. While vertical scaling is part of the Solana roadmap, one criticism is that it sacrifices decentralization. One mark of decentralization is the ease at which one can run a validator, and higher compute requirements and technical complexity makes validation services only possible for a select few. Another criticism is that it is a temporary band-aid to congestion. As a monolithic blockchain increases throughput, more applications and more users will consume that blockspace resulting in congestion again. In an effort to maintain decentralization and explore more sustainable ways to scale, other blockchains networks have explored a modular approach.

Modular Blockchains

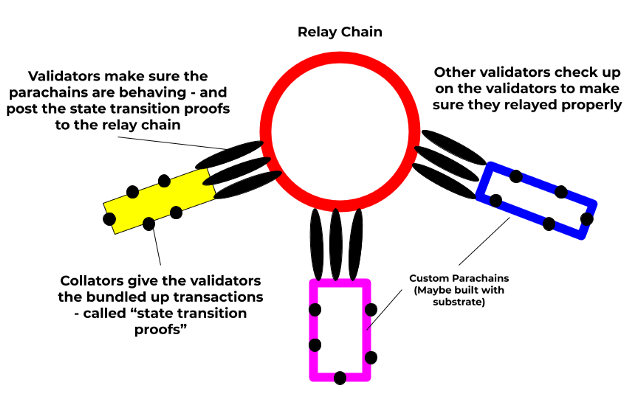

In modular blockchain architectures, the responsibility of DECS is split amongst various parties. For example, in Polkadot, Collators are responsible for ordering and executing transactions on a specific parachain. These transactions are then posted as proofs on the main relay chain for Polkadot; relay-chain validators are then responsible for settlement and finalizing those transactions in addition to any messages between parachains. Because execution and ordering (consensus) is separated from settlement and data availability, higher throughput can be achieved.

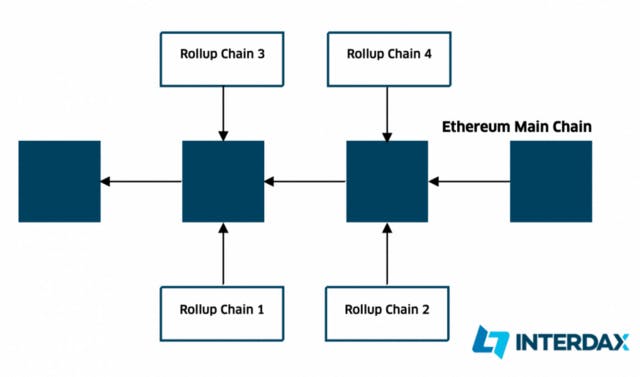

This approach is not dissimilar to the Eth 2.0 roadmap that relies on roll-up technology for execution. While the specific minutiae of roll-ups will be covered in a future blog post, roll-ups function in a similar manner. Optimistic and ZK-rollups are responsible for ordering and executing transactions and then posting proofs of transaction execution to the base Ethereum chain, where they are settled.

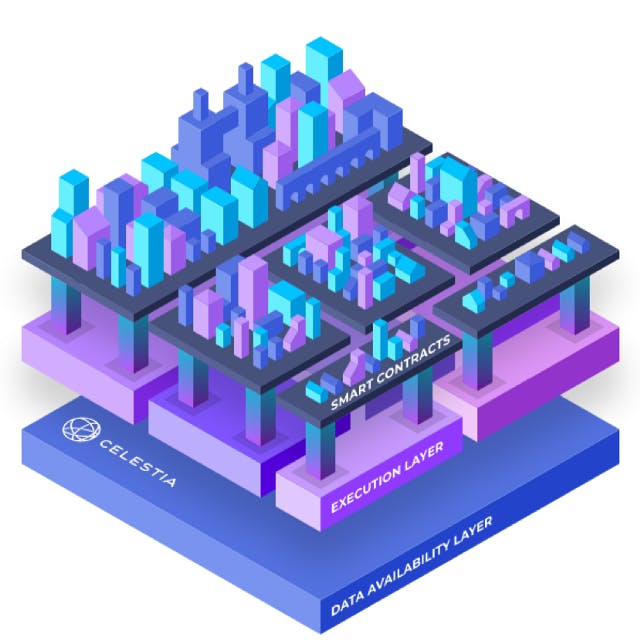

Celestia is a project pioneering a modular approach to blockchains that is built on top of Tendermint. Celestia aims to build a layer-1 proof-of-stake blockchain that provides data availability and consensus. Celestia allows developers to build their own plug and play roll-ups to order and execute transactions on top of Celestia’s data availability and consensus layer.

Modular blockchains are rising in popularity as dApps developers can access greater throughput for their application while still relying on the economic security of a shared settlement layer. As opposed to monolithic blockchains where dApps compete for throughput, a parachain on Polkadot has its own dedicated throughput; a roll-up on Celestia or Ethereum can similarly reserve throughput for its own application. While all these approaches come with a good deal of technical complexity, applications can avoid congestion issues that may be inherent in monolithic blockchains.

One of the criticisms of the modular approach is that while the settlement layer in a modular blockchain may be decentralized, the execution layer may have a certain degree of centralization where a single actor is responsible for processing transactions. Composability — a main feature of monolithic blockchains — is also difficult to achieve in a modular framework. While some protocols, like Layer-Zero, are working on cross-messaging solutions to enable composability, much of this technology is new and has yet been fully battle-tested.

Multi-Chain Ecosystems

Cosmos is the pioneer of the multi-chain ecosystem. From the DECS perspective, the Cosmos architecture appears to be similar to a monolithic blockchain: validators of an app-chain are responsible for execution, consensus, data availability and settlement. The subtle difference that separates a multi-chain approach from a monolithic (or modular) chain is that applications do not share final settlement, consensus, execution or data availability. Whereas every dApp on Solana settles to the Solana blockchain, or every parachain is ultimately settled on the Polkadot relay chain, each app-chain within Cosmos relies on itself for settlement.

By having each application on its own chain, the Cosmos can scale horizontally. More through-put is added to the ecosystem via the creation of more application specific blockchains. By separating the settlement of each application to its own blockchain, Cosmos has pioneered the notion of sovereignty. Via IBC, app-chains can communicate with each other, thus preserving some of the benefits of composability and token transfer that is possible on monolithic chains.

Some consider the lack of a final settlement layer as a negative from a community-building perspective when compared to modular or monolithic frameworks. For example, dApps that deploy on a monolithic chain like Solana can rely on the Solana community to bootstrap an initial user base. Parachains on Polkadot can build a community via parachain auctions. In contrast, sovereign chains that don’t rely on some other chain for some aspect of DECS have a more difficult time building community. As a result, many Cosmos-based chains like Osmosis, Juno or Evmos, have conducted massive airdrops for ATOM stakers, hoping that the Cosmos Hub can provide the community inherent in other modular/monolithic blockchains.

Others consider a lack of a final settlement layer as a negative since each application must build its own economic security. This requires a significant lift from the application developers to design a staking token, gather a validator set, correctly incentivize the stakeholders and pay for security. Even after this severe lift, the market-cap of the top app-chains in the Cosmos is typically in the hundred of millions (as of May 2022), whereas the market-cap of the top monolithic or modular blockchains is greater than $10 billion; the cost to attack any single app-chain is far less than its monolithic/modular counterparts. That said, the lack of a final settlement layer can actually strengthen the security of the whole ecosystem of applications. To understand why, let’s consider the downfall of Terra, one of the most successful applications built using the Cosmos SDK, prior to its collapse in May 2022.

Compartmentalized Security of the Multi-Chain

Terra, a project developed by Do Kwon and Terraform labs, was one of the first projects to build an app-chain using the Cosmos SDK. Terra customized its chain to build an algorithmic stablecoin named UST, which was primarily backed by the staking token LUNA. While LUNA had a meteoric rise in 2021 and the first quarter of 2022, an insufficient mechanism led to UST losing its peg to the U.S. Dollar. This de-pegging event resulted in a death spiral for the value of LUNA. On April 5th, 2022, LUNA reached a market-cap of over $40 billion. By Friday, May 13th the LUNA market-cap catered to less than $10 million, and nearly all on-chain value was completely destroyed.

While the consequences of the collapse of Luna will have after-shocks that will reverberate for a crypto generation, it’s important to note that the security of the other app-chains within Cosmos was unaffected. Because each app-chain is sovereign and has independent settlement layers, the security of each app is unaffected by the fragility of other applications. The rest of the Cosmos ecosystem — Cosmos Hub, Osmosis, Akash, Regen, etc. — kept steadily producing blocks during the UST collapse and after Terra halted. The beauty of the Cosmos ecosystem lies in its self-sovereignty — each app-chain can be connected to other app-chains, but they do not need to rely on each other to continue settling transactions.

Consider the fate of Astroport and Crescent — two DEX’s built in the Cosmos ecosystem that both heavily relied on UST — the former built on Terra and the latter built on its own self-sovereign app-chain. While both of these DEX’s heavily utilized UST, Astroport relied on Terra for security, while Crescent had its own staking token and validator set. When Terra halted, Astroport also halted in the process; the $ASTRO token suffered a 98% price drawdown. In contrast, Crescent’s app-chain kept steadily producing blocks, and users maintained the ability to trade. The Crescent token (CRE) also outperformed ASTRO (although it did suffer an 80% drawdown as the rest of the market collapsed). Had Terra completely embraced the multi-chain vision of the Cosmos from the beginning, where each application lived on its own chain, it is possible that many of the dApps that utilized UST could have maintained liveness and trust while surviving through the crash. Instead, many dApps lost functionality when the chain halted, suffered near 100% loss in the value of their token and had to quickly decide whether to migrate to Luna 2.0, join another chain or decide to start from scratch and build their own chain from the ground-up.

Where Does Saga Lie?

Saga squarely fits into the multi-chain vision of the Cosmos and scales it. Chainlet developers on Saga can rely on the economic security of Saga’s validator set and also utilize the community of pre-existing Saga stakers and users to bootstrap their own community. Had Terra adopted Saga’s core architecture — each application living on its own chain — the fate of its ecosystem may have been quite different than what was seen in the first few weeks of 2022. Saga’s product — the automated deployment of single tenant VM’s onto dedicated chain’s (or chainlets), secured via interchain security by a shared set of validators has the following features:

- Permissionless deployment of code

- Customization of self-sovereign blockchain

- No upfront cost to launching a chainlet

- Predictable developer pricing for gas fees

- Dedicated blockspace for a developer’s applications, ensuring high throughput, easy upgradability and congestion relief.

In other words, applications deployed on Saga reserve their own dedicated blockspace, which is a feature that is not possible in monolithic blockchains. Applications deployed on Saga enjoy independence, meaning that block production on one chainlet is independent of the block production on other chainlets, a feature not shared in modular frameworks like Polkadot. Saga chainlets are self-sovereign and do not rely on a shared settlement, which is the case in Ethereum. In other words, Saga chainlets are as much a part of the Cosmos multi-chain ecosystem as any other application-based chain.

That said, multichain and modular are not mutually exclusive. Saga has chosen to focus on the multi-chain solution first because it offers a more compelling solution to developers. However, once modular blockchain technology is more ready for mainstream adoption, Saga chainlets can be adapted to be both modular and multichain.

Conclusion

As blockchain technology continues to proliferate into the 2020s, there is no doubt that there will continue to be breakthroughs that address the blockchain trilemma and innovate along consensus, execution, data availability and settlement. Saga is uniquely positioned within the Cosmos ecosystem to innovate on shared security and offer dApp developers an ideal environment to build both their communities and robust blockchain applications.

To learn more about Saga, follow us on Twitter or join our Discord.

Great Articles to Read

https://members.delphidigital.io/reports/l1-vs-l2-entering-the-endgame

https://members.delphidigital.io/reports/pay-attention-to-celestia

https://members.delphidigital.io/reports/valuing-layer-1s-memes-money-or-more

https://medium.com/momentum6/modular-blockchains-the-next-alpha-celestia-overview-456ca5bbf9b1

https://twitter.com/buchmanster/status/1525150966139469825?s=21&t=JvAP1Anq6tFhw1QduoEXYw